Legalization is All About the Money

TOBACCO, ALCOHOL, AND BIG PHARMA ARE ALL HEAVILY INVESTED IN MARIJUANA

Philip Morris International: $20M

Philip Morris International, one of the largest tobacco companies in the globe, invested $20M into Syqe Medical, an Israeli marijuana company that has created a marijuana inhaler.

PYXUS: $20M

Canadian tobacco maker, Alliance One International, purchased a 40% stake in Critically, a North Carolina based CBD-hemp company for an estimated $10M. Alliance One is entitled to extend the investment to 50% in March of 2020.

Imperial Brands: $20M

Canadian tobacco maker, Alliance One International, purchased a 40% stake in Critically, a North Carolina based CBD-hemp company for an estimated $10M. Alliance One is entitled to extend the investment to 50% in March of 2020.

Altria: $1.8B

Altria Group, maker of Marlboro, invested $1.8B in Cronos for a 45% stake in the Canadian-based marijuana company.

JUUL:

PAX Labs, founded by Adam Bowen and James Monsees, spun off Juul Labs from their vaporizer brand. The spun-off Juul boasted a product with the capacity of 200 puffs a day, equivalent to a pack of cigarettes, and pioneered a patent in nicotine salts. The ensuing teen vaping addiction epidemic has been owed to Juul’s innovative technology and aggressive youth marketing.

Anheuser Busch: $50M

Anheuser-Busch invests $50M; partners with Tilray through subsidiary brand Labatt to create a marijuana infused drink.

Constellation Brands: +$4B

Constellation Brands upped an initial investment in Canopy Growth from a 9.9% stake to a 38% stake valued at an additional $4B; the beer maker will be eligible to purchase 139.7 million more shares for $5B.

Heineken:

Heineken subsidiary, Lagunitas, partnered with CannaCraft brand Absolute Xtracts to create a non-alcoholic marijuana infused beer. The initial hope was to create a hop-derived terpene for Absolute Xtract’s vape cartridges, which turned into a beer with marijuana terpenes. The idea was rejected by the federal Alcohol and Tobacco Tax and Trade Bureau.

Molson Coors:

Molson Coors elected to partner with HEXO (Hydropothecary Corporation) to develop marijuana-infused beverages. Molson Coors is entitled to purchase shares of HEXO through the deal.

Patron Spirits:

Former alcohol executive, Ed Brown of Patron Spirits International, recently joined as an executive at Surterra Wellness.

Bacardi:

Former alcohol executive, Lee Applbaum of Bacardi, recently joined as an executive at Surterra Wellness.

Teva:

Teva Pharmaceuticals agreed to a partnership with Australian marijuana company, CannaDoc. Through the deal, Teva Pharmaceuticals will distribute CannaDoc’s medical marijuana through pharmacies in Israel.

Novartis:

Sandoz AG, a subsidiary of Novartis, agreed to a partnership with Tilray to co-brand and distribute non-smokable and non-combustible marijuana products. Financials were not disclosed.

Purdue:

Former Purdue Pharmaceuticals CEO, John Stewart, recently decided to take up marijuana. He founded Emblem, a Canadian medical marijuana company, shortly after leaving Purdue.

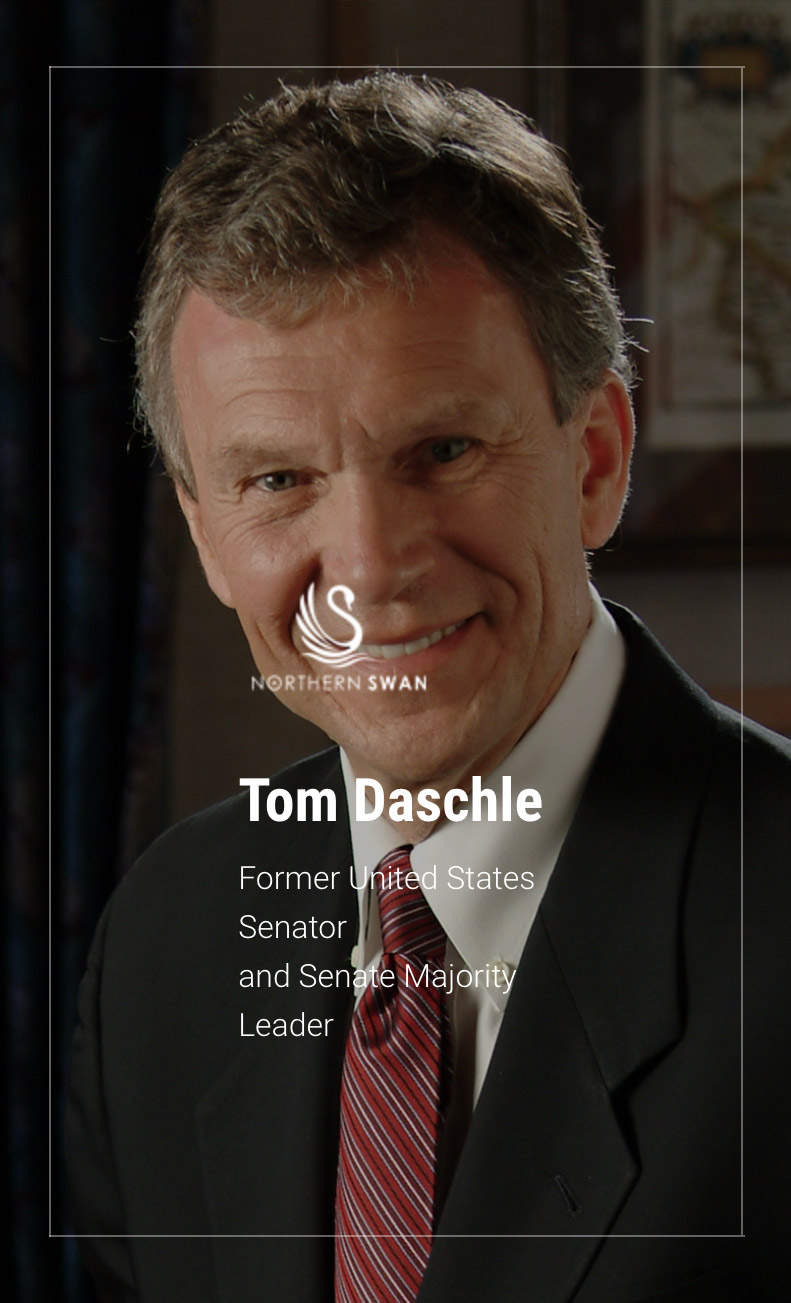

Tom Daschle

Tom Daschle, former Senate Majority and Minority Leader for the United States Senate joined the board of advisors for New York-based marijuana investment firm Northern Swan Holdings Inc in May of 2019. Additionally, Daschle’s lobbying firm, Baker Donelson, touts its involvement in representing marijuana industry clients.

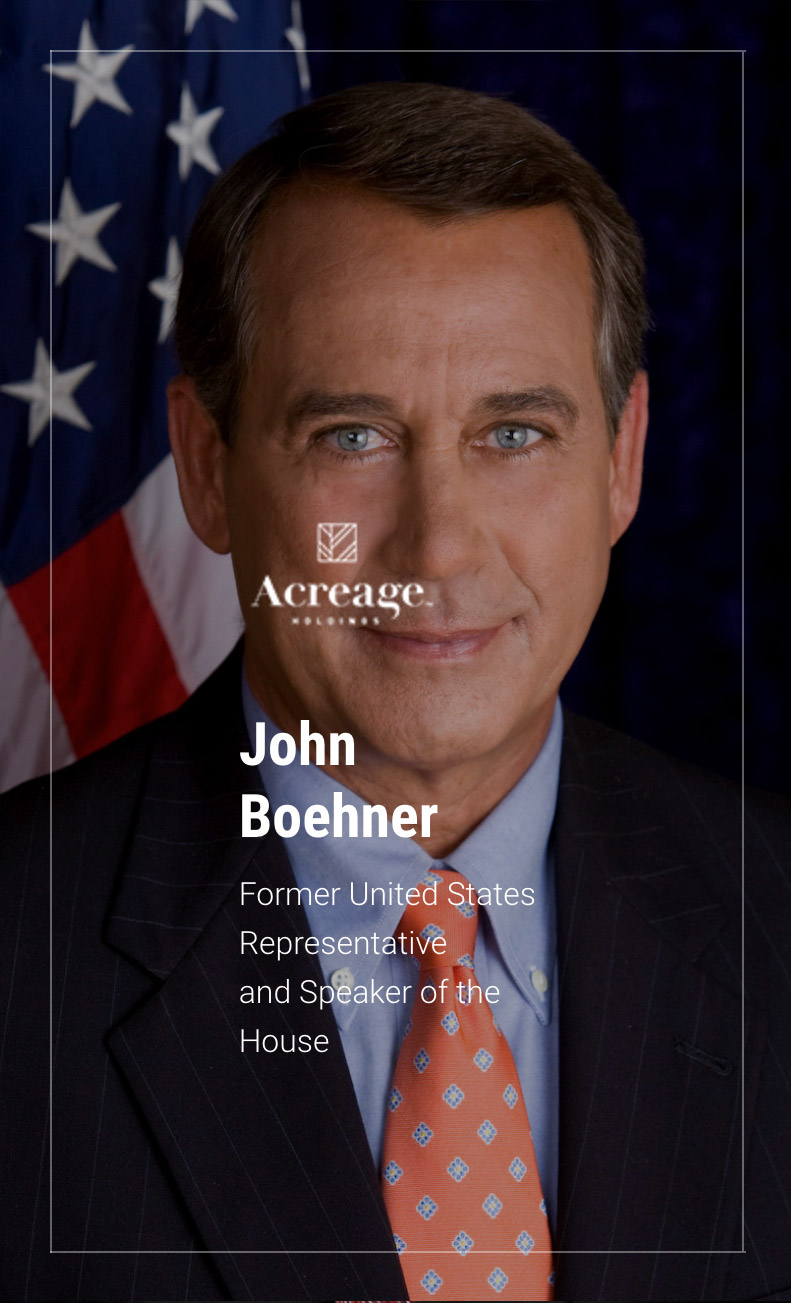

John Boehner

Former United States Representative and Speaker of the House, John Boehner, now sits on the Board of Directors at Acreage Holdings, a marijuana investment firm. The former Speaker once described himself as “unalterably opposed to the legalization of marijuana,” and was “concerned that legalization will result in increased abuse of all varieties of drugs, including alcohol.” His greatest fears seemed to be assuaged by his new position. In the event that the United States legalizes marijuana, Mr. Boehner stands to gain $20 million over-night.

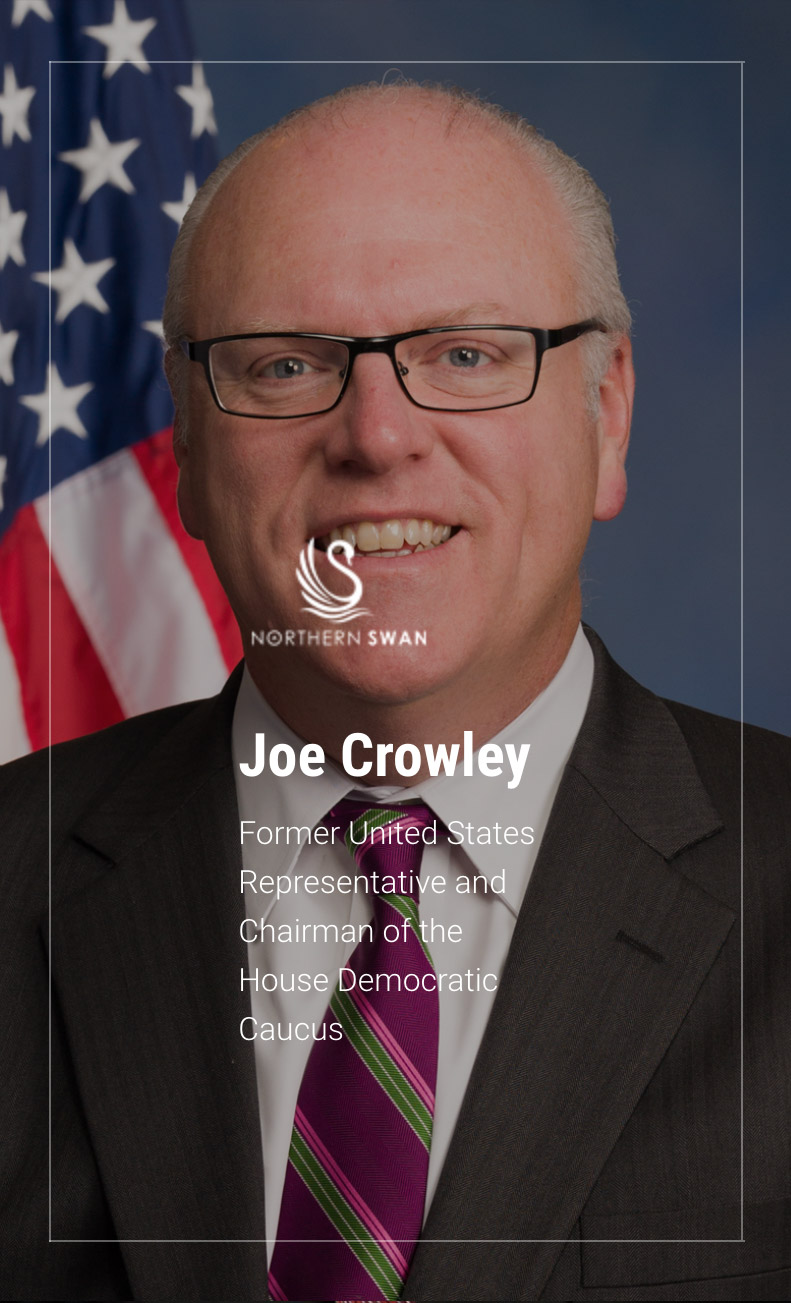

Joe Crowley

Upon exiting Congress in 2018, Joe Crowley joined former Senate Majority Leader Tom Daschle as a member of the board of Advisors for New York-based marijuana investment firm Northern Swan Holdings Inc. Additionally, Mr. Crowley joined lobbying firm Squire Patton Boggs in February of 2019 as a Senior Policy Advisor. Squire Patton Boggs notably represents the National Cannabis Roundtable, a marijuana industry coalition dedicated to instituting federal legalization.

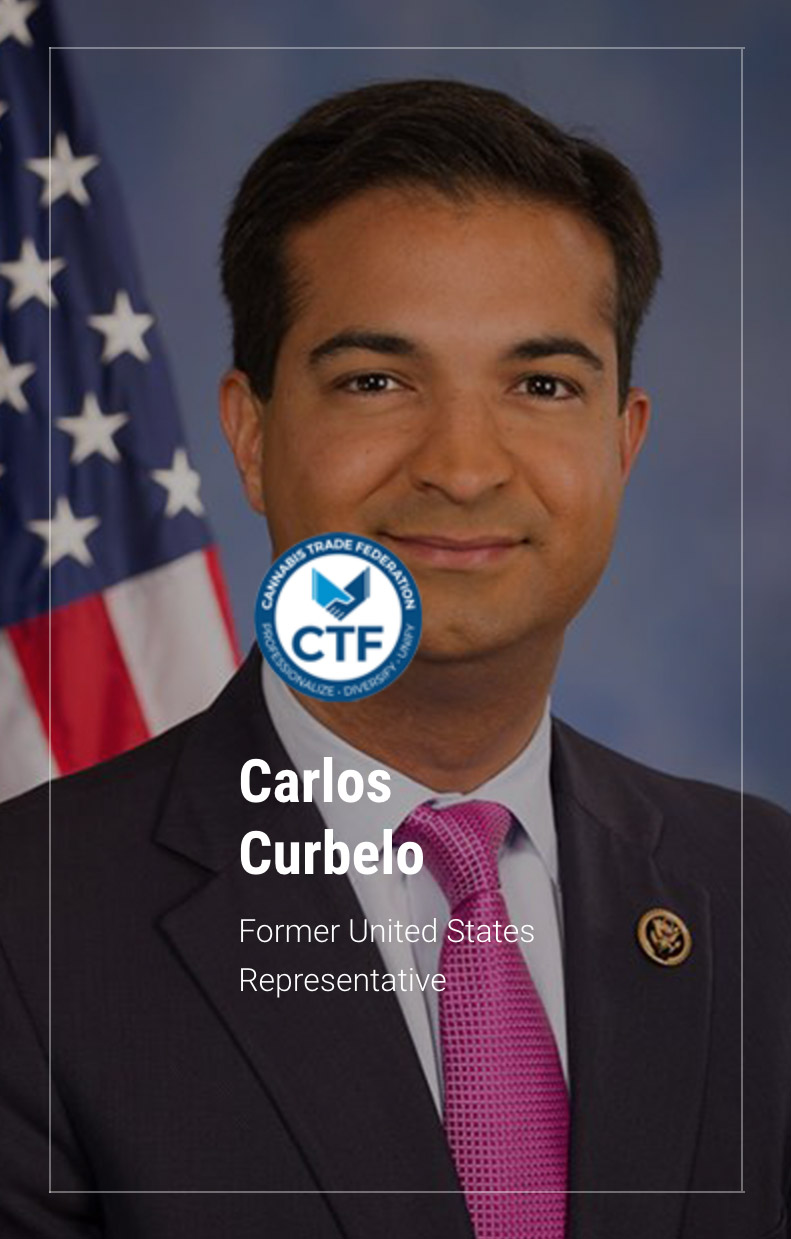

Carlos Curbelo

Following his exit from Congress in 2019, Carlos Curbelo joined the Cannabis Trade Federation as a “strategic advisor.” The Cannabis Trade Federation has worked with members of Congress to lobby in support fo the STATES Act, a bill Curbelo co-sponsored.

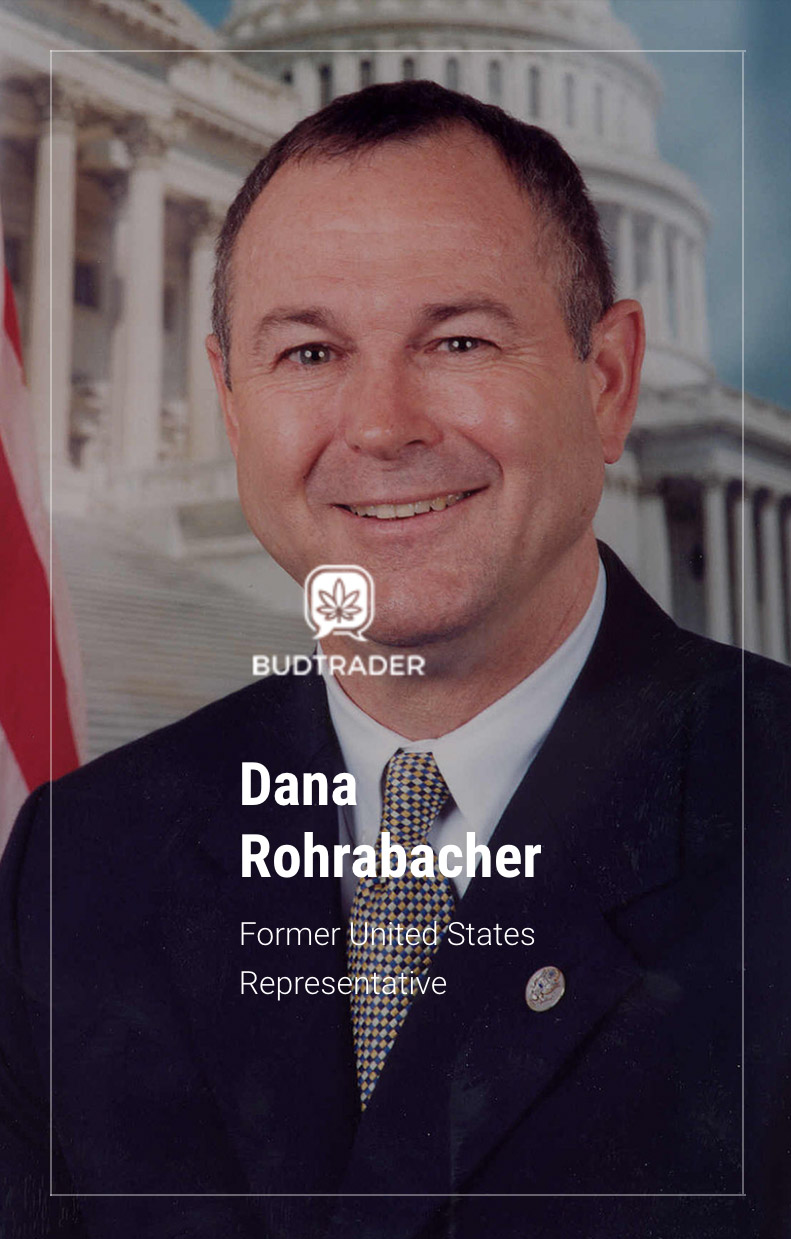

Dana Rohrabacher

In May of 2019, after serving 15 terms in Congress and sponsoring numerous marijuana industry-supported pieces of legislation, California representative Dana Rohrabacher became the majority shareholder and member of the advisory board for BudTrader, the so-called “Craigslist of Weed.”